Do you want to invest your money? Looking for the best website and app? Here is the complete list of the best investing apps and websites to invest money safely.

Investing money is one kind of passive income. However, you have to invest your money in the right place. Otherwise, you will lose all the money which you don’t want. That is why before investing your money in any place, you need to be careful. Because investing always carries its risks.

Even if it carries risks, it is one of the easiest ways to make money. You can use your existing money to generate more money if you choose the right place to invest.

However, there are lots of people that choose the wrong place to invest their money. In that case, they lose all their money. For that reason, I am publishing this article in order to list the best investing apps and websites so that you choose the right platform to invest your money safely.

Before introducing the best investing apps and website, I would like to tell you one thing that if you haven’t started investing yet, start doing it right away. Because it will help you to secure your future.

So, let’s see which are the best investing apps and websites.

15 Investing Apps and Websites

Stash

Stash is an American financial technology and financial services company. It founded by Ed Robinson, David Ronick, and Brandon Krieg in 2015. It is a web platform and mobile apps, allowing users to invest small amounts of money as little as $5.

Stash is the best place for beginners. You will get full control over your investment. There are 11 categorize available to invest your money such as industrial, consumer staples, health care, media, etc. You can choose where you want to invest your money.

It is the best platform to invest your money as a beginner. Because it also provides tips and tools to build your portfolio. Stash pricing starts at $1 per month. So, use this platform to invest your money in big companies.

Seedrs

Seedrs is the United Kingdom-based equity crowdfunding platform that is created to invest money easily. It is the best platform for startup owners and potential backers.

Investing in this platform is very easy. Once your investor profile is complete, you will be able to access all campaigns to invest your money. Even you can ask entrepreneurs questions and request further information before investing your money.

After that, you can invest your money via debit card or bank transfer. You can invest as little as £10. If the Entrepreneurs not met within 60 days, you will get your money back. Also, you can try their secondary market where you can trade your shares with other investors.

Until now, total investments recorded on Seedrs £925.5 Million. Moreover, this platform TrustPilot rated 4.4 out of 5. So, invest your money on this platform safely.

Acorns

Acorns is another best platform to invest your money. If you want to secure your future then you can use Acorns to invest money in stocks and bonds.

Acorns is giving you the opportunity to invest your spare change from every purchase you make throughout your day. For example, if you spend $4.50 on lunch, it rounds the amount to $5 and you can invest an additional $0.50. So, it is the best place to invest a little amount of money and secure your financial future.

Acorns membership will cost you $1 or $3 per month. More than 7 million people using Acorns to investing spare change from everyday purchases. Moreover, if you want to know how to get more from your money then you will find lots of articles and videos from financial experts.

M1 Finance

M1 Finance is probably one of the best platforms for those who want to invest their money for a longer period of time. It is a long term investment Robo-advisor for people that will help your money to work for you.

The M1 Finance process is straightforward to use. First of all, you need to create a free account and choose a portfolio template that fits your goal. You can select a plan for retirement or for income earners. If you don’t like to go with any option, then you can create your own investment pie.

If you use a taxable account, then you have to invest at least $100 and if you use a retirement account, then you have to invest at least $500. Although, there are no commissions but there are fees for mailings, wire transfers, etc.

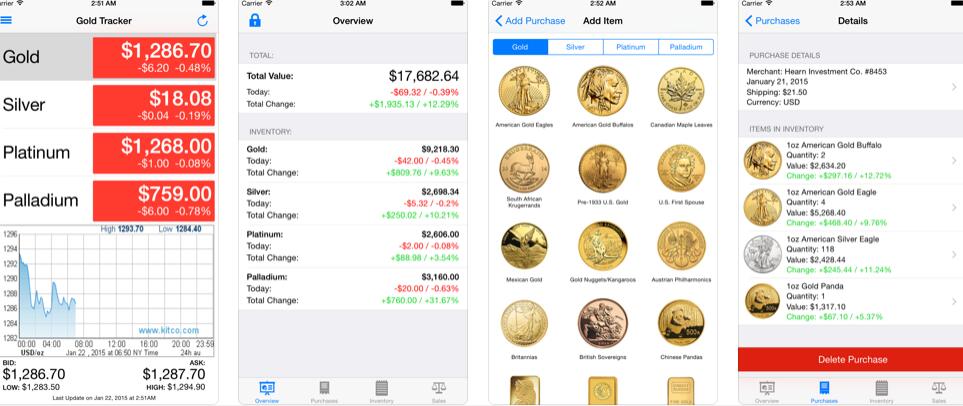

Gold Tracker

Gold Tracker is the best app for those who want to invest gold, platinum, silver, and palladium. It is the premier precious metals asset management app for IOS. If you want to control your investment then Gold Tracker might come in handy.

Gold Tracker is the best app to manage your precious metal resources with a clean user interface. Furthermore, it is an iOS app so that android users can’t use this app. If you want to use this app then you have to spend $2.99.

Robinhood

Robinhood is an app that makes it easier to buy and sell stocks for free. It is a pioneer of a commission-free investing app that gives you more ways to make your money work harder.

Now, you might be thinking about how does Robinhood makes money then. Well, a Robinhood gold account carries a minimum investment of $2,000. A gold account user needs to pay a fee of $6 per month.

It is the best place for beginners allowing you to trade for free. However, there are a few problems like the lacks of analytics and educational tools. In that case, you need to use other financial apps like Bloomberg or Benzinga.

Betterment

Betterment is another best platform for beginners to invest their money. It is an excellent Robo-advisor for youngers to invest their money. You can start with as little as $1.

When you use Betterment, you don’t need to think much about risks. Because it seeks to minimize investment risks and maximize the returns. You don’t need to do much work in order to invest your money. All you need to do is that state your income and goals. After that, Betterment’s award-winning management system will do all the work for you. So, you don’t need to involve too much with investing.

Betterment doing business since 2010. That means it is doing business for more than 10 years. Betterment’s service charge is very low. You have to pay a $0.25 annual fee. If you use a premium account then you have to pay a 0.40{4735d816038fdbdee5a50d7fc49fefa7d7d953fa694c32729cd78f30b0e29684} commission with more than $100,000.

FeeX

If you want to reduce your commission fees then you need to use FeeX. This amazing platform will help you to reduce your commission fees if you have an old 401 (k) or an IRA savings account.

The best thing about this platform is that it is totally free. You don’t have to pay a single penny in order to use this platform. Then how this platform earns money? FeeX earns its share via referral agreements with other financial service providers. So, it is a win-win situation for both sides.

SigFig

SigFig is another best Robo-advisor service that lets you manage and improve your investments. However, it offers customized portfolios starting at $2,000 which is the highest starting investment level on this list.

SigFig is a very good platform to find the recommended portfolio that fits your needs. All you need to do is that enter your age and term (Short, Intermediate, Long). After giving this information, SigFig will recommend the best-suited portfolio that fits your needs.

Furthermore, it offers portfolio tracking, human advice for free. This will help you to invest your money on your SigFig account. SigFig only charges accounts that exceeded $10,000. Annually they charge 0.25{4735d816038fdbdee5a50d7fc49fefa7d7d953fa694c32729cd78f30b0e29684}. Moreover, accounts between $2,000 and $10,000 are managed for free.

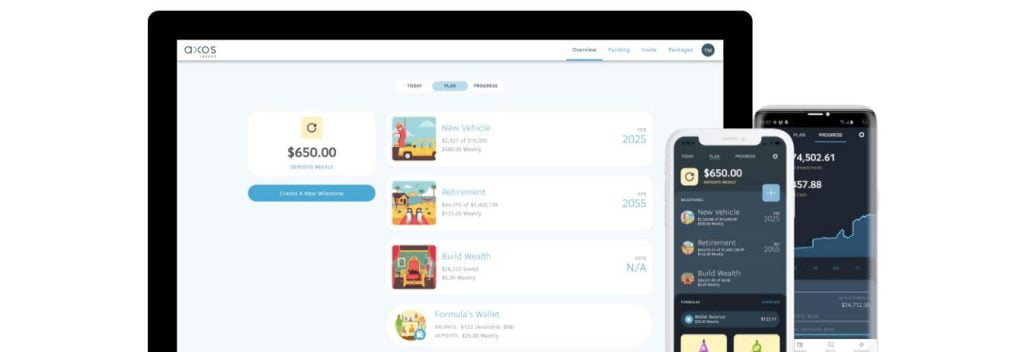

Axos Invest

Axos Invest is a Robo-adviser service. However, it is more than a Robo-advisor. The best thing about this site is that they don’t charge any fees.

Axos Invest Features are:

- Wise Harvesting: This is a tax-loss harvesting investment strategy that monitors your price levels to capture small losses throughout the year to reduce your annual tax bill.

- Selective Trading: It allows you to exclude specific ETFs from being traded in your portfolio, potentially minimizing wash sales.

- IRAutomation: It offers three different IRAs (Roth, Traditional, and SEP) that provide unique benefits either in the form of tax savings in the current tax year or long term tax savings when withdrawing in retirement.

So, it is a very good investment service with many advanced features.

Wealthfront

Wealthfront is one of the best Robo-advisors that is designed to earn you more. It is probably the best service that is best suited for young investors.

Wealthfront comes with a handy features like:

- Tax-loss harvesting

- Financial planning

- Direct indexing

- Free portfolio reviews

Wealthfront initial investment is $500. In that case, you have to pay a $0.10 advisory fee per month. If your account balance is $10,000, then you have to pay a $2.08 advisory fee per month.

Vanguard

Vanguard is an American investment advisor. This company founded by John C. Bogle in 1975. Vanguard is one of the world’s largest investment companies with 30 million investors. Moreover, they manage over 6.2 trillion in assets.

However, it is the best platform to invest long-term retirement accounts for 401 (k), IRAs, and many more. One downside about this site is that it is not the best option who is looking for buying and selling stocks.

So, invest on this site for your retirement.

Webull

Webull is another best site to invest money in stocks, trading, etc. The best thing about this site is that it is totally free. You don’t have to pay a single penny to this site.

There are two different types of brokerage accounts to satisfy your different investment objective such as:

- IRA

- Individual Brokerage Account

A comprehensive suite of investment products such as:

- Stocks

- Options

- ETFs

- ADRS

Opening a Webull account is very easy. You need a couple of things like a government-issued ID card with your photo, name, and date of birth is required to open an account.

Estimize

Estimize is a financial estimate service that proven to be more accurate than Wall Street 74{4735d816038fdbdee5a50d7fc49fefa7d7d953fa694c32729cd78f30b0e29684} of the time. Estimize crowdsources earnings and economic estimates from 103,932 hedge funds, brokerage, independent, and amateur analysts. So, this platform can produce unbiased and accurate financial predictions.

You can use Estimize to make your investment decisions and forecast the profits of your portfolio. Registration on Estimize is free so that everyone can join.

Degiro

Degiro is one of the fastest growing online brokers in Europe. While using Degiro, you are getting access to a wide range of products on more than 50 international exchanges at extremely low fees.

More than 450,000 investors using this platform to invest their money and generate more money. So, it is one of the best online brokers to invest money.

Honorable Mentions of Investing Apps and Websites

I have accommodated the best investing apps and websites in this list. However, there are a few more investing apps and websites available to try one. That is why I am mentioning them on this list. If you like to use them then look at those.

WrapUp

Investing apps and websites are the best platform to invest your money and secure your future. While using investing apps and websites, you can generate more money from your existing money. So, you need to invest money and generate more.

Hopefully, this article helps you to know about the best investing apps and websites. If you like it then feel free to share it with your friends.