Are you looking for the best budget apps? Yes? Here are some of the best budgeting apps for every type of budgeter.

Budgeting apps are something that’ll help you to save tons of money by tracking your spending. By using a budgeting app, you’ll be able to see where your money is going. This is the common benefit of using a budgeting app.

However, there are a few budgeting apps available that offer more than tracking your spending. Budgeting apps also provide various tips so that you can save more money than you expect.

When you start using a budgeting app, you’ll be able to see improvement in your finances. As you may know, there are lots of budget apps available out there. In that case, finding a suitable budget app can cause trouble. For that reason, I’ve found some of the best budget apps for every type of budgeter based on ratings and reviews.

So, let’s see which are the best budget apps that’ll help you to track your spending and improve your finances.

Best Budget Apps

1. Mint: Budget Tracker & Planner

Price: Free

Mint is one of the best budget apps that’ll help you to track your budget. As it is a free budget app, you don’t have to spend a single penny.

First of all, you need to connect your financial accounts with Mint. After that, Mint will track and categorizes your transactions. Moreover, you’ll get alerts when you’re exceeding your budgets, unusual spending like large or suspicious transactions, and ATM fees. Also, it will track your bills and remind you to pay bills on time.

As you can see, you’re getting lots of features by using this budget app for free. Therefore, use this free budget app to track your spending and planning your budget.

2. PocketGuard: Personal Finance Simplified

Price: Free / Premium: $3.99/mo

PocketGuard is another budget app that’ll help you to track your spending and categorize your budget. It’ll connect your checking, credit, and savings accounts. Also, it’ll detect recurring bills and income. After that, they show how much spendable money you have after setting aside enough for bills, goals, and necessities.

PocketGuard also allows you to personalize your reports with custom categories and #hashtags. Even they’re offering better rates on your cable, cell phone, and other bills. You’re getting all of these features with this budget app for free. Therefore, you should give this budget app a try.

3. Empower

Price: 14 Day Free-Trial / $8/mo

Empower is the best budget app that anyone can use. Empower was voted by Time Magazine as one of the best budget apps of the year. It’s offering lots of features that’ll help you in your budgeting, such as:

- Set spend limits and cut unnecessary expenses

- Automatic savings

- Interest checking

- Get personalized tips on where and how to save more

If you’re not familiar with a budgeting app, then you should use this app. It provides default categories you can choose from and create spending limits based on your income. That makes it the best beginner-friendly budgeting app.

4. Tiller

Price: 30 Day Free Trial / $6.58/mo

Tiller is the best budget app for those who are spreadsheet lovers. If you want maximum flexibility to customize your budget, then Tiller is the one that you should use. Tiller automatically updates Google Sheets and Microsoft Excel with your spending, income, and balances each day.

All you have to do is link your financial accounts with Tiller. After that, you can go for either Google Sheets or Excel to automatically categorize your spending. As it is the most flexible automated personal finance tool, you can create your own categories and track multiple budgets with variable time periods.

As you can see, there are lots of things you can do with Tiller. For that reason, this budgeting tool is worth using.

5. YNAB: You Need A Budget

Price: 34 Day Free-Trial / $11.99/mo

You Need A Budget, also known as YNAB. It is the best budget app for those who are fans of the zero-based budget system. For that reason, you must make a plan for every dollar you earn.

All you have to do is connect bank accounts, set goals, contribute to savings, and customize spending categories. You’ll be able to access real-time information that will help you to budget properly. Moreover, they’ll deliver budgeting advice and free workshops.

To access this budget app, you need to invest a little amount of money. You can buy either a monthly plan ($11.99) or an annual plan ($84).

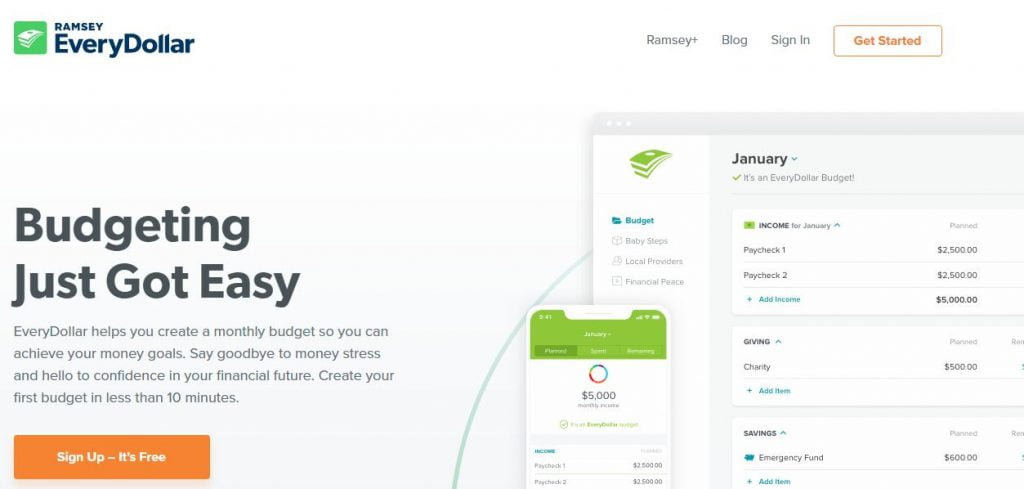

6. EveryDollar

Price: Free / EveryDollar Plus: $129.99/y (14-Day Free Trial)

EveryDollar is another zero-based system budgeting app that will help you to track your spending and plan for purchases. It’ll help you to create a monthly budget so you can achieve your monthly goals.

First of all, you need to start your budget by adding the income you expect to make per month. After that, you need to make a plan for your income. It’ll provide you with a customizable template for budgeting your monthly expenses. Next, all you need to do is follow your plan by keeping track of your spending throughout the month.

If you want to connect your bank account for faster expense tracking and easier budgeting, then go for EveryDollar Plus. It’ll cost you $129.99 per year after a 14-day free trial.

7. Honeydue

Price: Free

Honeydue is a perfect choice for couples. It’ll allow each partner to stay up to date on account balances and bill due dates. Even it’ll allow each partner to split bills within the app. For that reason, it is the best budget app for couples.

The best thing that I love about this app is the messaging feature. If there are any suspicious transactions, you can message your partner to know about them. That’ll help you to clear things up pretty quickly.

Moreover, the app will give you total control over sharing information. That means you’ll be able to decide how much information you want to share with your partner. Therefore, if you’re looking for a budget app for couples, then here it is.

8. Goodbudget

Price: Free / Plus Version: $7/mo

Goodbudget is an envelop system budgeting app. Goodbudget will allow multiple users to access the same account. For that reason, it’s a great budget app for family and friends.

Unfortunately, you won’t be able to sync your bank accounts with this app. You have to add account balances manually. With the free version, you’ll get one account, two devices, and limited envelopes. With the premium version, you’ll get unlimited envelopes and accounts.

Therefore, it’s the best budget app for envelope system budgeting. If you’re looking for such an app, then here it is.

9. Personal Capital

Price: Free

Basically, Personal Capital is an online financial advisor and personal wealth management company. Primarily it’s an investment tool, but they also offer features that help budgeters to track their spending. You can connect and monitor checking, savings & credit card accounts, IRAs, 401(K)s, mortgages, and loans.

It will list recent transactions by category. You can customize each category and see the percentage of total monthly spending. Also, they serve up a net worth tracker and portfolio breakdown. Therefore, use this app to save more money for your future.

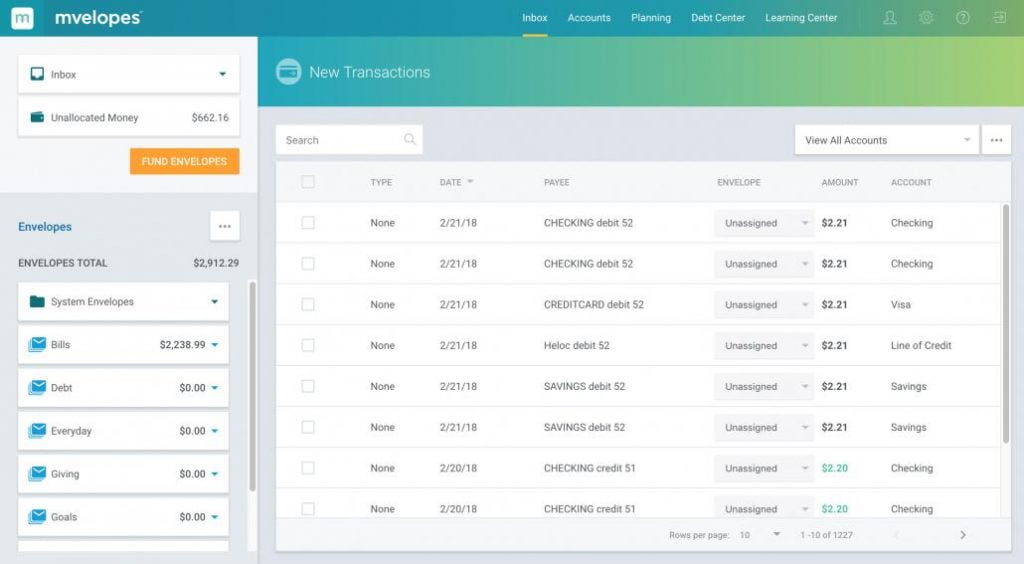

10. Mvelopes

Price: 60-Day Free Trial / Basic: $6/mo, Premier: $9.95/mo, Plus: $19/mo

Mvelopes is an alternative to GoodBudget. If you prefer an envelope and zero-based budgeting system, then you should use this one. It’ll help you to save money for your future and avoid debt. Unlike GoodBudget, you’ll be able to sync your bank accounts with Mvelopes.

It’ll break down your budget into different categories. You can track your spending and see how much you have left in each category before spending any money.

Honorable Mentions of Budgeting Apps

Here are some of the more budgeting apps that may work well for you. All of these apps didn’t make our list. You can check over whether any of these apps work well for you or not.

- Clarity Money: It’ll allow you to categorize your expenses, track your purchases, and get insight into your monthly spending. Most importantly, it’s a free budget app.

- Wally: Here is another app that’ll help you to budget, track your spending, set saving goals, and up to date information on your spending.

- Copilot: It’ll help you to find out where your money is going. That means it’ll help you to stay on budget by connecting your bank accounts, categorize your expenses, track upcoming bills, and so on.

Why do you need a budgeting app?

After knowing about all of these budgeting apps, you’re well aware of what all of these budgeting apps are offering.

A budgeting app can help you to save tons of money by tracking your earning and spending. Also, a budgeting app tells what you may need to change to save more money. There are a few budget apps available that’ll track your bank accounts and credit card balances as well.

Basically, a budgeting app will help you to stay on budget. That way you can save more money for the future. After using a budgeting app, you’ll be able to see an improvement in your finances.

How to decide which one is better for you?

As you can see, there are lots of budget apps available. For that reason, it’ll be difficult for beginners to choose one among these budget apps.

Before choosing a budget app, you need to research it. You can read reviews to know about a budget app. All you have to do is search on Google for a budget app. By doing so, you’ll be able to find out whether the budget app is good enough or not.

If you don’t have money to start, then you can go for a free budget app. For that, you can use Mint. If you have some money to invest, then you can use PocketGuard. If you want to budget as a couple, then you can use Honeydue.

WrapUp

Budgeting is very important to save money for the future. As you can see, there are lots of budget apps available that’ll help you to budget easily by tracking your earnings and spending. All you have to do is choose the best budget app that works well for you.

Hopefully, this article helped you to know about the best budget apps. If you found it helpful, then share it with your friends.

Recommended Articles: